Taos Real Estate Market Report

January – September 2025 (9 months)

Through the first 9 months of the year, the number of sales of Single-family Homes are up; Condos are the same; and Land, Multi-family Homes, and Commercial are all down.

2025 has been a year of mixed performance. For Single-Family Homes, the market has turned up after declining in 2023 and 2024. It’s not a hot market, but at least it is moving up. Condo sales this year are tracking closely to last year’s pace, which isn’t much. Land sales continue the sharp down trend that began after 2022. High building costs and a labor shortage are making home building not very attractive. Multi-family sales are down significantly, no doubt due to higher interest rates affecting potential return on investment. Commercial investments are likewise negatively affected by higher interest rates, as well as by concerns about the health of the economy.

In general, people are not nearly as motivated to buy real estate as they were several years ago. A number of factors are causing people to adopt a cautious approach, viz., uncertainty about the economy and a possible recession, the alarming growth of the national debt, tariffs, trade wars, real wars, political chaos and gridlock emanating from Washington, etc. Inflation remains above target, and higher prices for everything are dampening consumer spending. Interest rates look set to remain in the the range of the past year, i.e., not coming down much. In short, a lot of reasons for people to wait to see how things develop before investing in real estate.

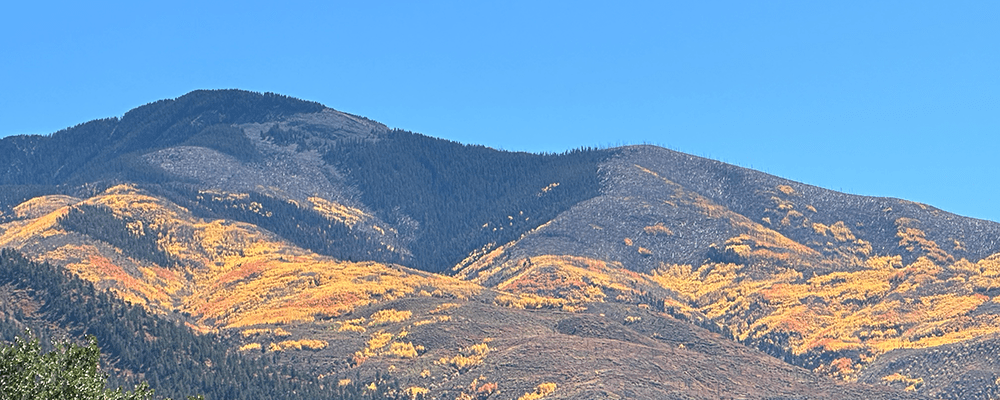

The long-term trend for Taos remains positive. This community will continue to draw people for whom the wonderful climate, amazing natural beauty, abundant recreational opportunities, vibrant cultural scene and laid-back lifestyle are attractive.

This report is designed to be best viewed on a computer; the data tables do not display well on mobile devices. We are working on adding graphs which will work better.

Click each title below to view the discussion and data for that property type.

Unit sales and average prices are both up this year.

For the year through nine months, the number of closed sales is 199 this year vs. 179 last year, an increase of 20 sales (+11.2%). Dollar sales are up by 19.9%.

The market boomed during the pandemic buying frenzy that started in 2020 and peaked in 2022. Sales then fell for two years, bottoming out in 2024. In 2025, both the number of sales and prices are showing gains over 2024 levels. It’s not a hot market, as people are not as determined to buy real estate as they were during the boom. The number of people actively looking to buy is down, while the inventory of homes available for purchase has increased significantly. As a result, the severe imbalance between supply and demand that existed during the boom has moderated. Buyers have more homes to choose from—and more room to negotiate price and terms. If they don’t find a house they really like and at a price they think is reasonable, they don’t buy. During the boom almost everything in reasonably good condition was selling at full asking price–or higher. There were often multiple offers and bidding competition. Now, many listings go through one or more price reductions before they sell.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 223 | 252 | 249 | 284 | 282 | 271 | 338 | 350 | 371 | 264 | 248 | 199 |

Median and Average Prices

The median price (midpoint in the range of sales prices from lowest to highest) for the year through September is $552,500, an increase of $22,500 (4.2%) over the same time frame in 2024.

The average (mean) for the first nine months is $611,500 this year vs. $566,900 last year, an increase of $44,600 (+7.9%). Here is how median and average prices have changed since 2016:

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| Median | $283,500 | $300,000 | $310,500 | $322,500 | $343,500 | $425,000 | $469,000 | $475,000 | $532,500 | $552,500 |

| Average | $306,100 | $326,800 | $369,500 | $373,100 | $398,700 | $513,800 | $558,900 | $545,000 | $592,800 | $611,500 |

Since 2020, when the market surge started, median price has increased 61%; the average is up 53%. In addition to the overall price level rising, there has been an increase in the proportion of sales of higher-priced homes. Buyers coming to Taos who sold a home in more expensive markets (e.g., California), or who had big gains in the stock market, could afford pricier homes here. Just looking at the $1 million+ segment, the number of sales increased from 4 in 2019 to 33 in 2022 before coming down to 21 in 2023, and 17 in 2024. So far in 2025, there have been 21 sales over $1 million.

Price Discounting

Through the first nine months of the year, actual sales price has averaged 5.1% less than the asking price when the home when under contract; it was 9.1% less then the initial asking price when the home was first listed. For the full year 2024, these discounts were 3.6% and 9.4%, respectively. The chart below shows that the discounts were lowest in 2022 at the height of the boom, and have been trending higher since then. Sellers who are pricing homes as if the market is as strong as it was in 2020-2022 are finding out that this is not a good strategy.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 18.4% | 16.9% | 13.9% | 13.3% | 9.4% | 10.3% | 7.8% | 7.2% | 4.5% | 3.8% | 8.4% | 9.4% | 9.1% |

Days On Market

For the first 9 months of 2025, the average number of days from the start of a listing to when the house went under contract is 123, almost exactly the same as last year (when it was 125). For the full year 2024, average DOM was 127. DOM dropped dramatically from 2013 through 2022 as demand outstripped supply. It started creeping upwards in 2023. With inventory starting to increase, and with people less eager to buy, this metric will probably continue to go up. Note that in Taos, average time to sell has always been much higher than in many parts of the country—where homes typically sell in 30-45 days. For the years 2003 – 2016, DOM averaged 250. Note: You can see data going back to 2003 by clicking the link at the beginning of this market report.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 244 | 235 | 235 | 226 | 192 | 147 | 151 | 156 | 141 | 112 | 117 | 127 | 123 |

INVENTORY

| Current | Year Ago | Sep 2008 | |

| Up to $200k | 7 | 6 | 190 |

| $200k – $300k | 23 | 10 | 109 |

| $300k – $400k | 48 | 30 | 69 |

| $400k – $500k | 46 | 28 | 39 |

| $500k – $650k | 45 | 29 | 35 |

| $650k – $800k | 36 | 34 | 27 |

| $800k – $1mil | 43 | 22 | 36 |

| Over $1mil | 51 | 49 | 13 |

| TOTAL | 299 | 208 | 518 |

UNIT SALES

| 2021 | 2022 | 2023 | 2024 | 2025 YTD | |||

| $0 – $200k | 44 | 26 | 18 | 12 | 8 | ||

| $200k – $300k | 49 | 47 | 24 | 21 | 16 | ||

| $300k – $400k | 64 | 72 | 49 | 43 | 26 | ||

| $400k – $500k | 55 | 62 | 58 | 38 | 32 | ||

| $500k – $650k | 53 | 66 | 45 | 49 | 43 | ||

| $650k – $800k | 34 | 43 | 32 | 36 | 35 | ||

| $800k – $1mil | 22 | 22 | 17 | 32 | 18 | ||

| Over $1mil | 29 | 33 | 21 | 17 | 21 | ||

| TOTAL | 350 | 371 | 264 | 248 | 199 |

Inventory

The supply of homes available for purchase has been growing this year. At the time this report was prepared, there were 299 homes listed for sale, up 91 houses (+44%) from a year ago, when inventory was at a low point. It appears that more homeowners are deciding that it is time to sell. They have either decided that they really want to move, or they are are afraid that if the market weakens they won’t be able to sell–at least not at a price they want.

Current inventory of 299 is still way below what was typical before the inventory starting shrinking in 2009. (In September of 2008 there were 518 homes on the market!) Taos inventory consists of a wide variety of size, price, style, location, and condition — everything from mobile homes to luxury homes, spread out over a large geographic area. With listings increasing, it is becoming a little easier to find more than just a few homes to show a buyer that meet most of his/her criteria.

Home Purchase Financing

| 2021 | 2022 | 2023 | 2024 | 2025 YTD | ||||||||

| Cash | 139 | 40% | 135 | 35% | 127 | 48% | 96 ( 39%) | 79 ( 40%) | ||||

| Conventional loan | 181 | 52% | 207 | 56% | 112 | 42% | 130 ( 52%) | 98 ( 49%) | ||||

| FHA loan | 14 | 4% | 7 | 2% | 8 | 3% | 8 ( 3%) | 7 ( 4%) | ||||

| VA loan | 11 | 3% | 13 | 4% | 6 | 2% | 11 ( 4%) | 5 ( 3%) | ||||

| Seller financing | 2 | 1% | 8 | 2% | 9 | 3% | 2 ( 1%) | 8 ( 4%) | ||||

| Other | 3 | 1% | 1 | 1% | 2 | 1% | 1 ( 1%) | 2 ( 1%) | ||||

| Total | 350 | 100% | 371 | 100% | 264 | 100% | 248 (100%) | 199 (100%) |

Interest Rates

Mortgage rates are at their lowest point over the past 12 months. The 30-year fixed rate loan is now averaging 6.27%. The high was 7.04% (on Jan. 16, 2025). Recent government data showing weakness in the labor market may cause the Federal Reserve to reduce short-term rates. However, mortgage rates are not directly affected by the Fed; they are geared to long-term bond rates, mainly the rate on the 10-year Treasury Note. The possibility that tariffs and other factors may cause inflation to remain above target, combined with bond market unease about burgeoning government debt, may cause long-term rates to remain at current levels or even increase. Therefore, mortgage rates probably won’t get down below 6%—unless we have a recession.

By now most people realize and accept that mortgage rates are not going back down to the super-low levels that occurred during 2009-2021. Those rates were created by the government’s “quantitative easing” program to prevent a possible depression after the Global Financial Crisis of 2008; the pandemic was another reason to keep rates suppressed. Excessive liquidity in the financial system and ultra-low interest rates caused asset prices (including real estate) to rise dramatically.

Some people may not remember that 6%-7% was a very normal mortgage rate for many years before 2008. Here is a link to the Federal Home Loan Mortgage Corporation (“Freddie Mac”) web site where you can see rates going back to the 1970’s: https://www.freddiemac.com/pmms

| Conventional 30-year fixed | 6.27% |

| Conventional 15-year fixed | 5.52% |

Note: Interest rates are impacted by occupancy, credit score, and down payment.

Foreclosure Sales

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| 50 | 49 | 34 | 34 | 29 | 25 | 17 | 9 | 5 | 0 | 4 | 4 | 4 | |

| 21% | 22% | 13% | 14% | 10% | 9% | 6% | 3% | 1% | 0% | 1% | 2% | 2% |

For the year through nine months, there have been 4 foreclosure sales. For all of 2024, there were just 4 foreclosure sales. In 2023 there were also just 4 foreclosure sales; in 2022 there were none. The number of foreclosures diminished steadily from a peak of 55 in 2012 during the aftermath of the Great Financial Crisis of 2008-2009. Currently, there are only 3 bank-owned houses listed for sale; none has a pending sale.

Please Note: These data do not include any condominiums developed or offered for sale by Taos Ski Valley Resort; those condos are not listed in the Taos MLS.

Condo sales are running about the same as last year.

Through the three quarters of 2025, unit sales are were just equal to the same period in 2024, at 38 condos sold. Dollar sales were down 4.9%. Whereas the inventory of single-family homes is growing, condo inventory remains very limited; this will constrain sales. We expect this year’s sales to continue to track about the same as last year.

2006 was the high-water mark for condo sales, when 149 units sold. There was much more inventory for buyers to choose from back in the early 2000’s. During the market boom, condo sales rallied from a low of 64 in 2014 to 92 in 2022 at the top of the cycle. But since then sales have declined steadily.

| 2006 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 149 | 64 | 68 | 67 | 61 | 66 | 79 | 74 | 82 | 92 | 58 | 56 | 38 |

Median price for the first 9 months was $387,500 vs. $385,800 in 2024, an increase of $1,700 (+0.4%). Average price was $412,400 vs. $433,900, a decrease of $21,500 (-5.0%). In a small data set with only 38 transactions, a few sales can skew the average price dramatically. The median is a more reliable indicator of price trend. As the year has progressed, the median is almost exactly the same as last year, i.e., prices are not rising but they are not falling either.

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| Median | $188,000 | $215,000 | $212,500 | $230,500 | $288,500 | $316,100 | $350,000 | $410,600 | $397,300 | $387,500 |

| Average | $212,900 | $243,800 | $248,900 | $265,800 | $293,200 | $331,400 | $398,200 | $474,100 | $429,100 | $412,400 |

Price Discounting

Through the year to September 30, final sales price averaged 3.2% less than the last asking price when the property went under contract, and 4.9% below the initial price when the property was first listed. Full-year 2024 discounts were 3.0% and 4.7%, respectively. Condo discounts are less than those for single-family homes (which are 5.1% and 9.1%, respectively, year-to-date), reflecting an even tighter inventory for condos than for homes.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 12.7% | 8.6% | 11.8% | 6.7% | 6.5% | 5.5% | 3.2% | 3.3% | 2.1% | 6.6% | 4.7% | 4.9% |

Days On Market – For the first 9 months of this year, DOM averaged 105 vs. 106 for the same time frame in 2024, another meytric that is tracking almost exactly the same this year vs. last year.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 237 | 324 | 259 | 195 | 125 | 178 | 111 | 152 | 122 | 109 | 107 | 105 |

Inventory

The number of condos listed for sale at the time of this report was 43, up 5 from three months ago, and up 7 from a year ago. Of the 43 condos currently listed for sale, 7 are at Taos Ski Valley; 36 are in and near central Taos. Those 36 available condos range in price from $220,000 for a 314-square foot studio unit in central Taos to $899,000 for a 3BR/2BA, 2,189-sq. ft unit with a 2-car garage also close to Town center.

In 2005-2006, when condo development was at its peak, there were often approximately 200 condos on the market at any given time, with the majority in or near central Taos. There were 149 condos sold in 2006. The table below shows a steady decrease in average inventory for each year from 2013 to 2023, and not much increase since then.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 81 | 78 | 65 | 58 | 59 | 56 | 49 | 48 | 39 | 23 | 32 | 31 |

INVENTORY

| Current | Year Ago | Sept 2008 | |

| Up to $200k | 1 | 1 | 40 |

| $2010k – $300k | 6 | 5 | 50 |

| $301k – $400k | 8 | 8 | 51 |

| $401k – $500k | 14 | 12 | 56 |

| $501k – $750k | 10 | 9 | 29 |

| over $750k | 4 | 1 | 0 |

| TOTAL | 43 | 36 | 226 |

UNIT SALES

| ’21 | ’22 | ’23 | ’24 | ’25 | |||||

| Up to $200k | 16 | 7 | 2 | 1 | 1 | ||||

| $201k – $301k | 19 | 24 | 13 | 13 | 7 | ||||

| $301k – $401k | 29 | 26 | 12 | 14 | 14 | ||||

| $401k – $500k | 12 | 21 | 10 | 12 | 8 | ||||

| $501k – $750k | 5 | 10 | 14 | 15 | 7 | ||||

| over $750 | 1 | 4 | 7 | 1 | 1 | ||||

| TOTAL | 82 | 92 | 58 | 56 | 38 |

| Condo Financing | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD | ||||

| Cash | 43 | 58% | 36 | 44% | 45 | 49% | 38 | 66% | 32 (57%) | 25 (66%) |

| Conventional loan | 30 | 41% | 45 | 55% | 47 | 51% | 20 | 34% | 24 (43%) | 12 (32%) |

| Seller financing | 1 | 1% | 0 | 0% | 0 | 0% | 0 | 0% | 0 ( 0%) | 1 ( 3%) |

| Other | 0 | 0% | 1 | 1% | 0 | 0% | 0 | 0% | 0 ( 0%) | 0 (0%) |

| Total | 74 | 100% | 82 | 100% | 92 | 100% | 58 | 100% | 56 (100%) | 100 (100%) |

Foreclosure Sales

There have been no foreclosure sales of condos so far in 2025. There were none in 2024, 2023, 2022 or 2021.

Multi-family sales are almost nil.

Multi-family sales are almost not happening this year! Through nine months, there has been only one multi-family sale, whereas last year there were 8 during the same time period. No doubt this is due to higher interest rates affecting investors’ ability to achieve a satisfactory rate of return.

In an economy of higher interest rates, investors normally require higher “capitalization rates” to evaluate real estate investments. Investors divide a property’s Net Operating Income by their desired cap rate (expressed as a percentage) to calculate the price they will pay for the property to achieve the target rate of return. The higher the cap rate, the lower the value of a property. Although rents had been trending higher for years—due to an acute lack of inventory of long-term rental properties— rent increases appear to be moderating, despite the fact that very little new supply of rental properties has come on the market.

There is huge need for affordable housing—i.e., apartments—but “making the numbers work” in Taos has always been a challenge. For new construction, the high cost of land in suitable locations combined with high costs for materials and labor, make it difficult to achieve a reasonable rate of return.

Multi-family has always been a very small segment of the Taos real estate market; it will remain so.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 1 | 5 | 2 | 4 | 4 | 3 | 4 | 7 | 8 | 3 | 8 | 1 |

Currently, there are 9 multi-family properties listed for sale; two have sales pending.

The land market remains very slow.

Land sales continue to drop. Like condos, there was a small rally for about a year during the market boom. But since then, there has been a steady decline each year. For this year through September, the number of sales is 102 compared to 143 for the same time period in 2024, a decrease of 41 (-28.7%). Total dollar sales are up 12.1%, but that was due to two very high-dollar sales this year. (There was one sale $3 million for a commercial lot in town, and a residential home site at Taos Ski Valley sold for $1.7 million.) Excluding those sales, this year’s total dollar sales were 15% less than last year.

The primary constraints on land sales are very high building costs and the long lead time to start and complete construction of a home. There aren’t a lot of really good custom home builders working in Taos, and they are booked up for about two years. It costs at least $400 per square foot for the hard dollars of construction; this doesn’t include the land purchase, design, possible well drilling, septic system installation, and landscaping. It generally costs more to build a new home than to buy an existing home. The potential for costs to rise more, due to tariffs, could further impede land sales. With the supply of existing homes for sale increasing, buyers have even more reason to forego building a new home.

Back in peak year 2005, in the boom leading up to the Great Financial Crisis, there were 339 land sales, with a total dollar value of $46 million. Whereas sales of single-family homes had got back to the peak level of 2005 by 2021-2022, land sales are still way below the levels of 2004-2006.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 73 | 88 | 90 | 118 | 123 | 155 | 147 | 252 | 258 | 210 | 186 | 102 |

Price Level – Note: The following data on median and average price changes in 2025 should not be taken as valid indicators of the general price level for land.

Median price so far this year is $92,500 vs. $75,000 last year, an increase of $17,500 (+23.3%). Average (mean) price this year is $191,400 compared to $121,800 last year, a gain of $69,600 (+57.1%). Even if we exclude the two high-dollar sales noted above, the sales “mix” includes relatively more sales in the higher price brackets this year compared to last year. It is hard to make a case that land prices are rising.

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| Median | $52,300 | $64,500 | $62,300 | $67,200 | $ 70,000 | $ 75,000 | $ 75,600 | $ 72,000 | $ 75,000 | $ 92,500 |

| Average | $73,100 | $89,800 | $91,900 | $87,500 | $134,600 | $109,000 | $122,500 | $119,400 | $122,600 | $191,400 |

Current inventory of 378 tracts listed for sale is up 35 (+10%) from 343 at the beginning of the year, and up 10 (3%) from a year ago. Land inventory has fluctuated over time, but it has consistently been in the 350-450 range. This is a case of much more supply than demand. At the current absorption rate, 378 tracts equals a 2.8-year supply.

INVENTORY

| Current | Year Ago | |

| Up to $50k | 39 | 40 |

| $50k – $100k | 88 | 93 |

| $100k – $150k | 56 | 55 |

| $150k – $200k | 57 | 50 |

| $200k – $250k | 26 | 31 |

| $250k – $300k | 24 | 16 |

| Over $300k | 88 | 83 |

| TOTAL | 378 | 368 |

UNIT SALES

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | ||

| 53 | 86 | 71 | 53 | 44 | 19 | ||

| 57 | 84 | 97 | 86 | 73 | 37 | ||

| 17 | 26 | 31 | 24 | 22 | 15 | ||

| 16 | 23 | 18 | 14 | 23 | 9 | ||

| 4 | 14 | 12 | 8 | 7 | 3 | ||

| 0 | 7 | 6 | 12 | 4 | 3 | ||

| 4 | 12 | 23 | 13 | 13 | 16 | ||

| 147 | 252 | 258 | 210 | 186 | 102 |

Price Discounting

For the January – September period, actual selling price averaged 10.3% below the last asking price when the property went under contract; the discount from original price when the land was first listed 14.2%. For full year 2024, these discounts were 8.0% and 10.9%, respectively. In 2023, they were 8.8% and 12.9%.

Days On Market

The average days on the market for the first half of 2025 was 476, down from 487 for the same time frame in 2024, a slight decrease of 11 days (-2%). As the chart below illustrates, DOM for land has varied from a low of 332 to a high of 605 over the past 12 years; the average is 445.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD | |

| 390 | 605 | 464 | 472 | 388 | 332 | 471 | 351 | 437 | 421 | 534 | 476 |

How Land Purchases Were Financed

| 2022 | 2023 | 2024 | 2025 YTD | ||||

| Cash | 188 (75%) | 168 (80%) | 140 ( 75%) | 84 (82%) | |||

| Conventional loan | 35 (14%) | 24 (12%) | 27 ( 15%) | 7 ( 7%) | |||

| Seller financing | 28 (11%) | 18 ( 8%) | 16 ( 9%) | 9 ( 9%) | |||

| Other | 1 (0%) | 0 ( 0%) | 3 ( 1%) | 2 ( 2%) | |||

| Total | 252 (100%) | 210 (100%) | 186 (100%) | 102 (100%) |

The commercial market is weak.

During the first nine months of 2025, there has been only 3 closed commercial transactions; that is down four sales from 2024 for the same time period. In the full year 2024, there were eight commercial sales compared to six in 2023. After a boomlet in 2022—when there were 18 closed sales— the commercial market has come down to a more typical level for Taos. The chart below shows that 6-8 commercial transactions per year has been the norm in our small market. At this point, it looks as if 2025 will fall short of that norm. Higher interest rates have had a negative impact. As with multi-family property, higher interest rates affect return on investment, and/or the buyer’s ability to qualify for a loan. Additionally, misgivings about the health of the economy, and an ongoing shortage of labor, have made commercial investments less attractive at this point in time.

The Taos retail sector was severely impacted by the road improvement project for the main commercial thoroughfare through town. This project dragged on for years, snarling traffic and discouraging shoppers. New higher parking fees in the Central Business District have added to merchants’ woes, although after push-back from businesses the Town rescinded them temporarily.

Nevertheless, there is some commercial development happening along the main corridor through town: two gas stations, a new tire store, and an expansion of the Town’s only car dealership, to name several.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 YTD |

| 3 | 17 | 7 | 8 | 14 | 12 | 8 | 8 | 18 | 6 | 8 | 3 |