Taos Real Estate Market Report

January – December 2025 (12 months)

For the year, the number of sales of Single-family Homes were up; the rest of the market (Condos, Multi-family, Land, and Commercial were all down.

Single-Family Home sales turned up after declining in 2023 and 2024. Condo sales have been in a downtrend since 2022. Land sales continue to fall as high building costs are making home building not very attractive. Multi-family sales are down significantly from last year’s pace, no doubt due to higher interest rates affecting potential return on investment. Commercial investments are likewise negatively affected by higher interest rates, as well as by concerns about the health of the economy.

In general, the year 2025 was fraught with an almost daily barrage of unsettling news, and this made people much less motivated to buy real estate than they were several years ago. Uncertainty about the economy and a possible recession, consumer frustration with high prices for everything except gasoline, and anxiety about the political/social stability of the country, combined to cause a lot of potential buyers to adopt a wait-and-see attitude.

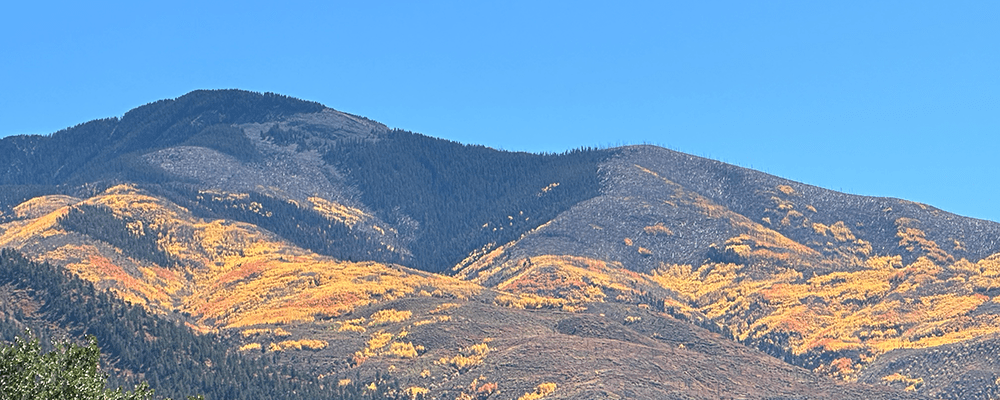

The long-term trend for Taos remains positive. This community will continue to draw people for whom the wonderful climate, amazing natural beauty, abundant recreational opportunities, vibrant cultural scene and laid-back lifestyle make it an attractive place to live.

This report is designed to be best viewed on a computer; the data tables do not display well on mobile devices. We are working on adding graphs which will work better.

Click each title below to view the discussion and data for that property type.

Both the number of sales and average prices were up in 2025.

For January through December, unit sales were 278 this year vs. 248 last year, an increase of 30 sales (+12.1%). Dollar sales were up by 17.6%. Median price increased 3.5%, and average price gained 4.9%.

The market boomed during the pandemic buying frenzy that started in 2020 and peaked in 2022. Sales then fell for two years, bottoming out in 2024. In 2025, the market turned up, but it’s far from the red-hot market of 2020-2022. The number of people actively looking to buy was down, while the inventory of homes available for purchase increased significantly. As a result, the severe imbalance between supply and demand that existed during the boom has moderated. Buyers have more homes to choose from—and more room to negotiate price and terms. If they don’t find a house they really like and at a price they think is reasonable, they don’t buy. During the boom almost everything in reasonably good condition was selling at full asking price–or higher. There were often multiple offers and bidding competition. Now, many listings go through one or more price reductions before they sell.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 223 | 252 | 249 | 284 | 282 | 271 | 338 | 350 | 371 | 264 | 248 | 278 |

Median and Average Prices

The median price (midpoint in the range of sales prices from lowest to highest) in 2025 was $551,200, an increase of $18,700 (3.5%) over 2024’s median price of $532,500.

The average (mean) was $622,000 vs. $592,800 last year, an increase of $29,200 (+4.9%). Here is how median and average prices have changed since 2016:

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Median | $283,500 | $300,000 | $310,500 | $322,500 | $343,500 | $425,000 | $469,000 | $475,000 | $532,500 | $551,200 |

| Average | $306,100 | $326,800 | $369,500 | $373,100 | $398,700 | $513,800 | $558,900 | $545,000 | $592,800 | $622,000 |

Prices surged during the 2020 – 2022 boom. During those two years, the median price jumped 37% from 2020 to 2022. From 2020 to 2025, median price has increased 60% and average price is up 56%. And from 2016 to 2025, the median has almost doubled!

In addition to the overall price level rising, there has been an increase in the proportion of sales of higher-priced homes. Buyers coming to Taos who sold a home in more expensive markets (e.g., California), or who had big gains in the stock market, could afford pricier homes here. Just looking at the $1 million+ segment, the number of sales increased from 4 in 2019 to 33 in 2022 before coming down to 21 in 2023, 17 in 2024. then gaining back to 29 in 2025.

Price Discounting

For the year 2025, actual sales price averaged 5.1% less than the asking price when the home when under contract; it was 8.8% less then the initial asking price when the home was first listed. For the full year 2024, these discounts were 3.6% and 9.4%, respectively. The chart below shows that the discounts were lowest in 2022 at the height of the boom, and have been trending higher since then. Sellers who are pricing homes as if the market is as strong as it was in 2020-2022 are finding out that this is not a good strategy. Fewer homes are selling at full asking price; buyers expect to get some discount.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 18.4% | 16.9% | 13.9% | 13.3% | 9.4% | 10.3% | 7.8% | 7.2% | 4.5% | 3.8% | 8.4% | 9.4% | 8.8% |

Days On Market

The average number of days from the start of a listing to when the house went under contract was 121 in 2025, down from 127 in 2024. DOM dropped dramatically from 2017 through 2022 as demand outstripped supply. It increased slightly in 2023-2024, but seems to have stabilized in the 120-130 range. Note that in Taos, average time to sell has always been much higher than in many parts of the country—where homes typically sell in 30-45 days in normal times. For the years 2003 – 2016, DOM averaged 250. Note: You can see data going back to 2003 by clicking the link at the beginning of this market report.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 244 | 235 | 235 | 226 | 192 | 147 | 151 | 156 | 141 | 112 | 117 | 127 | 121 |

INVENTORY

| Current | Year Ago | Sep 2008 | |

| Up to $200k | 6 | 5 | 190 |

| $200k – $300k | 25 | 10 | 109 |

| $300k – $400k | 40 | 25 | 69 |

| $400k – $500k | 30 | 23 | 39 |

| $500k – $650k | 34 | 40 | 35 |

| $650k – $800k | 34 | 27 | 27 |

| $800k – $1mil | 39 | 22 | 36 |

| Over $1mil | 46 | 33 | 13 |

| TOTAL | 254 | 185 | 518 |

UNIT SALES

| 2021 | 2022 | 2023 | 2024 | 2025 | |||

| $0 – $200k | 44 | 26 | 18 | 12 | 9 | ||

| $200k – $300k | 49 | 47 | 24 | 21 | 22 | ||

| $300k – $400k | 64 | 72 | 49 | 43 | 41 | ||

| $400k – $500k | 55 | 62 | 58 | 38 | 44 | ||

| $500k – $650k | 53 | 66 | 45 | 49 | 60 | ||

| $650k – $800k | 34 | 43 | 32 | 36 | 45 | ||

| $800k – $1mil | 22 | 22 | 17 | 32 | 28 | ||

| Over $1mil | 29 | 33 | 21 | 17 | 29 | ||

| TOTAL | 350 | 371 | 264 | 248 | 278 |

Inventory

The supply of homes available for purchase increased substantially in 2025. At the time this report was prepared, there were 254 homes listed for sale, up 69 houses (+37%) from a year ago. During the past year, inventory reached a high point of 305 in August. It appears that more homeowners are deciding that it is time to sell. They have either decided that they really want to move, or they are are afraid that if the market weakens they won’t be able to sell–at least not at a price they want. With listings increasing, it is becoming a little easier to find more than just a few homes to show a buyer that meet most of his/her criteria.

Current inventory of 254 is still far below what was typical before the inventory starting shrinking in 2009. In September of 2008 there were 518 homes on the market! Taos inventory consists of a wide variety of size, price, style, location, and condition — everything from mobile homes to luxury homes, spread out over a large geographic area.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 363 | 364 | 324 | 316 | 284 | 264 | 274 | 257 | 225 | 217 | 168 | 180 | 249 |

Home Purchase Financing

| 2021 | 2022 | 2023 | 2024 | 2025 | ||||||||

| Cash | 139 | 40% | 135 | 35% | 127 | 48% | 96 ( 39%) | 113 ( 41%) | ||||

| Conventional loan | 181 | 52% | 207 | 56% | 112 | 42% | 130 ( 52%) | 135 ( 49%) | ||||

| FHA loan | 14 | 4% | 7 | 2% | 8 | 3% | 8 ( 3%) | 10 ( 3%) | ||||

| VA loan | 11 | 3% | 13 | 4% | 6 | 2% | 11 ( 4%) | 8 ( 3%) | ||||

| Seller financing | 2 | 1% | 8 | 2% | 9 | 3% | 2 ( 1%) | 9 ( 3%) | ||||

| Other | 3 | 1% | 1 | 1% | 2 | 1% | 1 ( 1%) | 2 ( 1%) | ||||

| Total | 350 | 100% | 371 | 100% | 264 | 100% | 248 (100%) | 278 (100%) |

Interest Rates

Mortgage rates are at their lowest point over the past 3 years. The 30-year fixed rate loan was averaging 6.09% at the time of this report’s writing. That’s down from just over 7% about a year ago. Recent government data showing weakness in the labor market may cause the Federal Reserve to reduce short-term rates. However, mortgage rates are not directly affected by the Fed; they are geared to long-term bond rates (mainly the rate on the 10-year Treasury Note). The possibility that tariffs and other factors may cause inflation to remain above target, combined with bond market unease about burgeoning government debt, may cause long-term rates to remain at current levels or even to increase. Therefore, mortgage rates probably won’t get down below 6%—unless we have a recession.

By now most people realize and accept that mortgage rates are not going back down to the super-low levels that occurred during 2009-2021. Those rates were created by the government’s “quantitative easing” program to prevent a possible depression after the Global Financial Crisis of 2008; the Covid-19 pandemic was another reason to keep rates suppressed and to flood the financial system with excessive liquidity. Ultra-low interest rates caused asset prices (including real estate) to rise dramatically.

Some people may not remember that 6%-7% was a very normal mortgage rate for many years before 2008. Here is a link to the Federal Home Loan Mortgage Corporation (“Freddie Mac”) web site where you can see rates going back to the 1970’s: https://www.freddiemac.com/pmms

| Conventional 30-year fixed | 6.09% |

| Conventional 15-year fixed | 5.44% |

Note: Interest rates are impacted by occupancy, credit score, and down payment.

Foreclosure Sales

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| 50 | 49 | 34 | 34 | 29 | 25 | 17 | 9 | 5 | 0 | 4 | 4 | 4 | |

| 21% | 22% | 13% | 14% | 10% | 9% | 6% | 3% | 1% | 0% | 1% | 2% | 1% |

For the year, there were just 4 foreclosure sales. For the years 2024 and 2023, there were also only 4 foreclosure sales in each of those years; in 2022 there were none. The number of foreclosures diminished steadily from a peak of 55 in 2012 during the aftermath of the Great Financial Crisis of 2008-2009. Currently, there is only 1 bank-owned house listed for sale.

Please Note: These data do not include any condominiums developed or offered for sale by Taos Ski Valley Resort; those condos are not listed in the Taos MLS.

Condo sales were down for the third consecutive year .

For the full year 2025, unit sales were 7 fewer than 2024, at 49 vs. 56 condos sold (-12.5%). Dollar sales were down 17.6%. Whereas the inventory of single-family homes has increased during the past year, condo inventory remains very limited; this has been a limiting factor for sales.

2006 was the high-water mark for condo sales, when 149 units sold. There was much more inventory for buyers to choose from back in the early 2000’s. During the 2020-2022 market boom, condo sales rallied from a low of 61 in 2017 to 92 in 2022 at the top of the cycle. But since then sales have declined steadily.

| 2006 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 149 | 64 | 68 | 67 | 61 | 66 | 79 | 74 | 82 | 92 | 58 | 56 | 49 |

Median price for the 2025 was $380,000 vs. $397,300 in 2024, a decline of $17,300 (-4.4%). Average price was $420,800 vs. $429,100, a decrease of $8,300 (-1.9%).

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Median | $188,000 | $215,000 | $212,500 | $230,500 | $288,500 | $316,100 | $350,000 | $410,600 | $397,300 | $380,000 |

| Average | $212,900 | $243,800 | $248,900 | $265,800 | $293,200 | $331,400 | $398,200 | $474,100 | $429,100 | $420,800 |

Price Discounting

For the whole year 2025, final sales price averaged 3.3% less than the last asking price when the property went under contract, and 5.1% below the initial price when the property was first listed. Full-year 2024 discounts were 3.0% and 4.7%, respectively. This increase, although marginal, indicates that the condo market has weakened some.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 12.7% | 8.6% | 11.8% | 6.7% | 6.5% | 5.5% | 3.2% | 3.3% | 2.1% | 6.6% | 4.7% | 5.1% |

Days On Market – In 2025, DOM increased slightly over 2024, from 107 to 113, another metric that indicates a softer market.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 237 | 324 | 259 | 195 | 125 | 178 | 111 | 152 | 122 | 109 | 107 | 113 |

Inventory

The number of condos listed for sale at the time of this report was 42, down 1 from three months ago. Of the 42 condos currently listed for sale, 12 are at Taos Ski Valley; 30 are in and near central Taos. Those 30 available condos in Town range in price from $200,000 for a 503-square foot 1-bedroom/1-bath unit in central Taos to $785,000 for a 2BR/2.5BA, 1,787-sq. ft unit with a 1-car garage also close to Town center.

In 2005-2006, when condo development was at its peak, there were often approximately 200 condos on the market at any given time, with the majority in or near central Taos. There were 149 condos sold in 2006. The table below shows a steady decrease in average inventory for each year from 2013 to 2023, and not much increase since then.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 81 | 78 | 65 | 58 | 59 | 56 | 49 | 48 | 39 | 23 | 32 | 36 |

INVENTORY

| Current | Year Ago | Sept 2008 | |

| Up to $200k | 1 | 0 | 40 |

| $2010k – $300k | 6 | 6 | 50 |

| $301k – $400k | 9 | 7 | 51 |

| $401k – $500k | 10 | 7 | 56 |

| $501k – $750k | 11 | 9 | 29 |

| over $750k | 5 | 2 | 0 |

| TOTAL | 42 | 31 | 226 |

UNIT SALES

| ’21 | ’22 | ’23 | ’24 | ’25 | |||||

| Up to $200k | 16 | 7 | 2 | 1 | 3 | ||||

| $201k – $301k | 19 | 24 | 13 | 13 | 8 | ||||

| $301k – $401k | 29 | 26 | 12 | 14 | 17 | ||||

| $401k – $500k | 12 | 21 | 10 | 12 | 9 | ||||

| $501k – $750k | 5 | 10 | 14 | 15 | 10 | ||||

| over $750 | 1 | 4 | 7 | 1 | 2 | ||||

| TOTAL | 82 | 92 | 58 | 56 | 49 |

| Condo Financing | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | ||||

| Cash | 43 | 58% | 36 | 44% | 45 | 49% | 38 | 66% | 32 (57%) | 31 (63%) |

| Conventional loan | 30 | 41% | 45 | 55% | 47 | 51% | 20 | 34% | 24 (43%) | 17 (35%) |

| Seller financing | 1 | 1% | 0 | 0% | 0 | 0% | 0 | 0% | 0 ( 0%) | 1 ( 2%) |

| Other | 0 | 0% | 1 | 1% | 0 | 0% | 0 | 0% | 0 ( 0%) | 0 ( 0%) |

| Total | 74 | 100% | 82 | 100% | 92 | 100% | 58 | 100% | 56 (100%) | 49 (100%) |

Foreclosure Sales

There were no foreclosure sales of condos in 2025. There were none in 2024, 2023, 2022 or 2021 either.

The Multi-family market had only 2 sales in 2025.

This was a big drop from 2024, when there were 8 closed sales. No doubt this is due to higher interest rates affecting investors’ ability to achieve a satisfactory rate of return.

In an economy of higher interest rates, investors normally require higher “capitalization rates” to evaluate real estate investments. Investors divide a property’s Net Operating Income by their desired cap rate (their required rate of return expressed as a percentage) to calculate the price they will pay for the property. The higher the cap rate, the lower the value of a property. Although rents had been trending higher for years—due to an acute lack of inventory of long-term rental properties— rent increases appear to be moderating, despite the fact that very little new supply of rental properties has come on the market.

There is huge need for affordable housing—i.e., apartments—but “making the numbers work” in Taos has always been a challenge. For new construction, the high cost of land in suitable locations combined with high costs for materials and labor, make it difficult to achieve a reasonable rate of return. Additionally, most multi-family properties listed for sale are small (typically 2- 4 units); therefore, management expenses further reduce Net Operating Income.

Multi-family has always been a very small segment of the Taos real estate market; it will remain so, at least in the near future.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 1 | 5 | 2 | 4 | 4 | 3 | 4 | 7 | 8 | 3 | 8 | 2 |

Currently, there are 11 multi-family properties listed for sale; one has a sale pending.

Land sales continue a downward trend.

Since a brief rally in 2021-2022 during the Covid pandemic boom,, there has been a steady decline each year. 2025 sales of 134 tracts was down 52 sales from 2024, a drop of 28%. Total dollar sales were actually up 11.2%, but that was due to relatively more high-dollar sales this year.

The primary constraints on land sales are very high building costs and the long lead time to start and complete construction of a home. There aren’t a lot of really good custom home builders working in Taos, and they are booked up for about two years. Generally, It costs more than $400 per square foot for the hard dollar cost of construction; this doesn’t include the land purchase, design, possible well drilling, septic system installation, and landscaping. The potential for costs to rise more, due to inflation and tariffs, could further impede land sales. With the supply of existing homes for sale increasing, buyers have even more reason to forego building a new home.

Back in peak year 2005, in the boom leading up to the Great Financial Crisis, there were 339 land sales, with a total dollar value of $46 million. Whereas sales of single-family homes had got back to the peak level of 2005 by 2021-2022, land sales are still well below the levels of 2004-2006.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 73 | 88 | 90 | 118 | 123 | 155 | 147 | 252 | 258 | 210 | 186 | 134 |

Price Level – Note: The median price—the price at which there is an equal number of sales above and below– is the better measure of the overall price level; the average price (total dollar sales divided by the total number of sales) can be skewed by several extremely high-priced sales, and also by relatively more sales in the higher price brackets.

Median price for the full year 2025 was $92,300 vs. $75,000 last year, an increase of $17,300 (+23.1%). Average (mean) price this year was $189,300 compared to $122,600 last year, a gain of $56,700 (+54.4%). The 2025 sales “mix” included relatively more sales in the highest price bracket (above $300,000) compared to last year. 2025 had one sale of $3 million, one at $1.7 million, and one at $1.55 million; the highest sale price in 2024 was $900,000.

| Price | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Median | $52,300 | $64,500 | $62,300 | $67,200 | $ 70,000 | $ 75,000 | $ 75,600 | $ 72,000 | $ 75,000 | $ 92,300 |

| Average | $73,100 | $89,800 | $91,900 | $87,500 | $134,600 | $109,000 | $122,500 | $119,400 | $122,600 | $189,300 |

Current inventory of 364 tracts listed for sale is within the 350-450 range that has been typical for most of the past 20 years. At the current absorption rate, 378 tracts equals a 2.7-year supply, i.e., much more supply than demand.

INVENTORY

| Current | Year Ago | |

| Up to $50k | 46 | 41 |

| $50k – $100k | 93 | 73 |

| $100k – $150k | 51 | 55 |

| $150k – $200k | 43 | 42 |

| $200k – $250k | 27 | 30 |

| $250k – $300k | 25 | 17 |

| Over $300k | 79 | 85 |

| TOTAL | 364 | 343 |

UNIT SALES

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | ||

| 53 | 86 | 71 | 53 | 44 | 23 | ||

| 57 | 84 | 97 | 86 | 73 | 50 | ||

| 17 | 26 | 31 | 24 | 22 | 20 | ||

| 16 | 23 | 18 | 14 | 23 | 12 | ||

| 4 | 14 | 12 | 8 | 7 | 5 | ||

| 0 | 7 | 6 | 12 | 4 | 3 | ||

| 4 | 12 | 23 | 13 | 13 | 21 | ||

| 147 | 252 | 258 | 210 | 186 | 134 |

Price Discounting

For the entire 12 months of 2025, actual selling price averaged 11.5% below the last asking price when the property went under contract; the discount from original price when the land was first listed 15.6%. For full year 2024, these discounts were 8.0% and 10.9%, respectively. In 2023, they were 8.8% and 12.9%. This metric supports the conclusion that the land market is weak.

Days On Market

The average days on the market for 2025 was 456, down from 534 in 2024, a decrease of 78 days (-15%). As the chart below illustrates, DOM for land has varied from a low of 332 to a high of 605 over the past 12 years; the average is 443.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| 390 | 605 | 464 | 472 | 388 | 332 | 471 | 351 | 437 | 421 | 534 | 456 |

How Land Purchases Were Financed

| 2022 | 2023 | 2024 | 2025 | ||||

| Cash | 188 (75%) | 168 (80%) | 140 ( 75%) | 114 (85%) | |||

| Conventional loan | 35 (14%) | 24 (12%) | 27 ( 15%) | 9 ( 7%) | |||

| Seller financing | 28 (11%) | 18 ( 8%) | 16 ( 9%) | 9 ( 7%) | |||

| Other | 1 (0%) | 0 ( 0%) | 3 ( 1%) | 2 ( 1%) | |||

| Total | 252 (100%) | 210 (100%) | 186 (100%) | 134 (100%) |

The commercial market was weak in 2025.

For the full year 2025, there were only 5 closed commercial transactions, a decline of 3 sales from 2024. After a boomlet in 2022—when there were 18 closed sales— the commercial market has come down to a more typical level for Taos (i.e., small). The chart below shows that 6-8 commercial transactions per year has been the norm.

Looking ahead, 2026 sales will probably fall within the historic range. Higher interest rates have had a negative impact. As with multi-family property, higher interest rates affect return on investment, and/or the buyer’s ability to qualify for a loan. Additionally, misgivings about the health of the economy, and an ongoing shortage of labor, have made commercial investments less attractive at this point in time. Nevertheless, there is some commercial development happening along the main corridor through town: two gas stations, a new tire store, and an expansion of the Town’s only car dealership, to name several.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| 3 | 17 | 7 | 8 | 14 | 12 | 8 | 8 | 18 | 6 | 8 | 5 |